Discover the 7 advantages of FIAs for retirement.

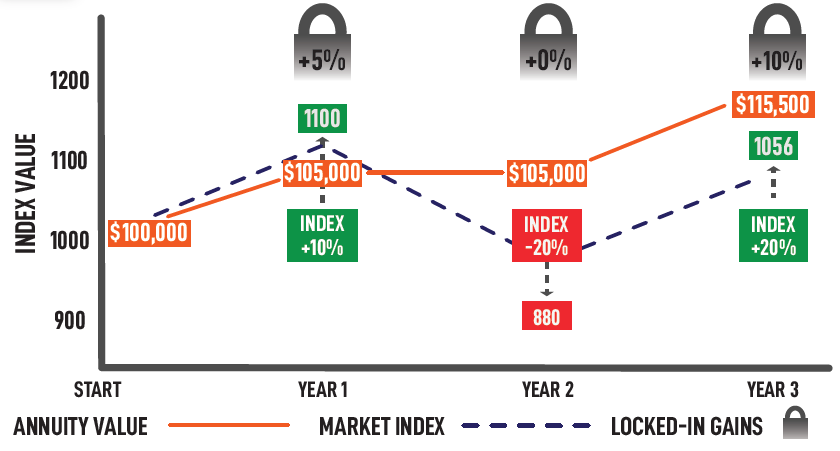

1. Power of Indexing

Indexing empowers your retirement savings by enabling participation in market gains while safeguarding against losses. Illustrated in the hypothetical example, when a market index like the S&P 500 rises, the FIA shares in the gains and secures them. Conversely, during market declines, the FIA preserves its value, ensuring your retirement remains secure. With Indexing, your principal and gains are shielded from market downturns, ensuring the safety of your retirement funds.

2. Safety and Security

We exclusively partner with financial institutions boasting an “A” rating or higher from leading financial rating agencies such as Moody’s, AM Best, Fitch, and S&P. This ensures that they possess outstanding financial prospects to safeguard your funds.

Moreover, all companies are registered as Legal Reserve entities in your residing state, mandating them to annually demonstrate at least one dollar of liquid reserves for every dollar of liability. Additionally, each state maintains a guarantee fund into which annuity companies contribute, offering an extra layer of security and assurance.

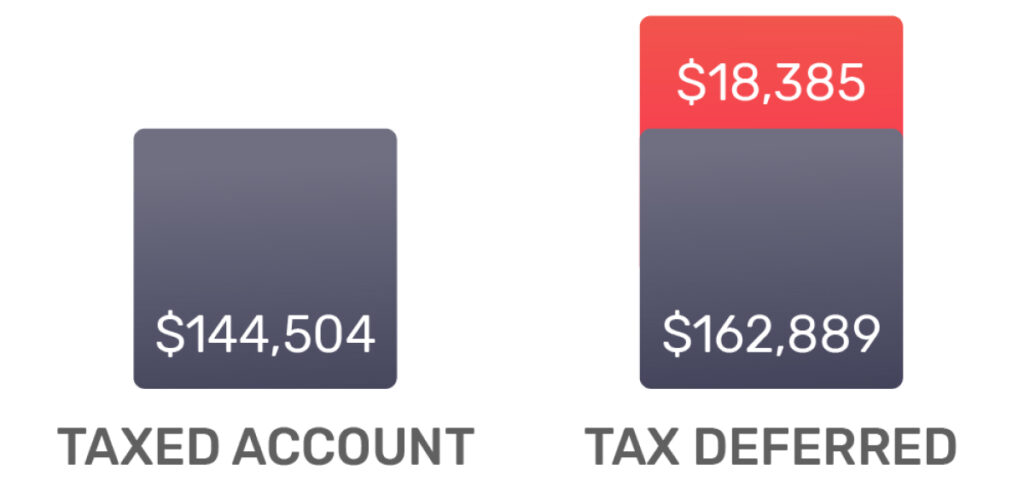

3. Tax Deferred Growth

FIAs enable your funds to grow without taxation. This leads to Triple-Compounding Interest, where you earn interest on your principal, interest on your accrued interest, and interest on the amount that would typically go towards taxes. For instance, in a 25% tax bracket and with a 5% annual gain, a $100,000 FIA would accumulate 12% more over 10 years compared to a non-tax-deferred investment like a bank CD.

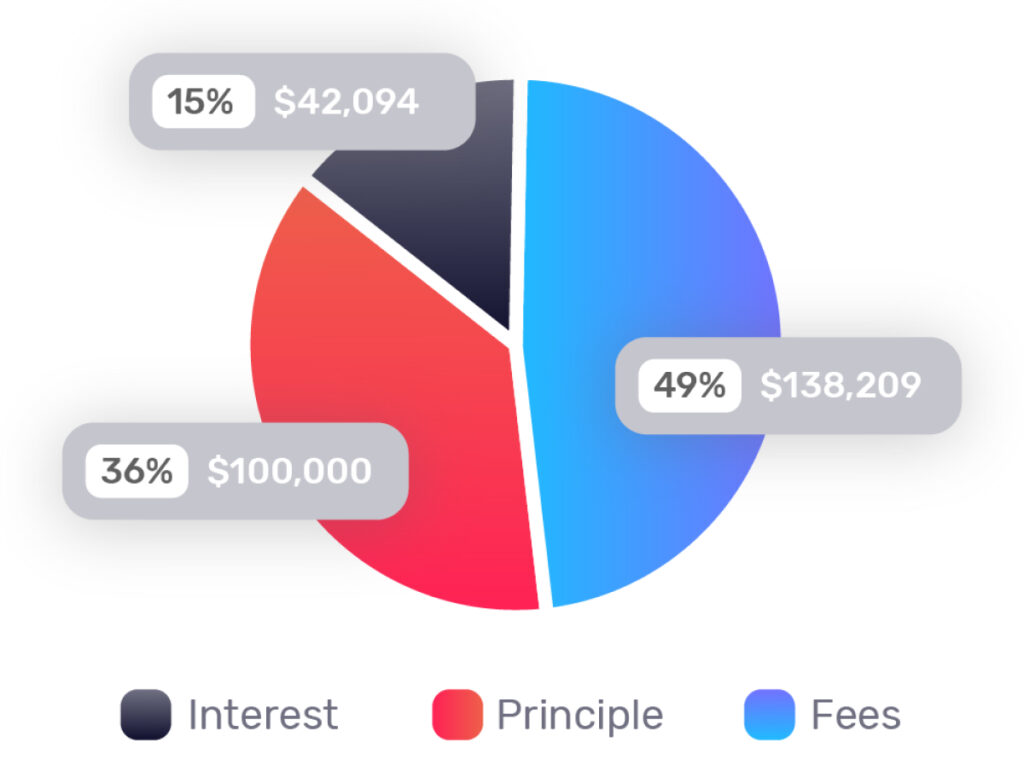

4. Eliminating Fees

While we can’t control market fluctuations, we have the power to manage the fees we incur. Many of us remain unaware of the fees we’re charged and how they diminish our savings. FIAs offer a solution by eliminating various fees common in traditional equity investments, including load fees, expense fees, and 12b-1 fees. According to the Investment Company Institute, the average annual fees (including expense ratio and 12b-1) for equity mutual funds stood at 1.50% per year. These fees, devoid of any guarantee, can significantly diminish your retirement savings over time.

The graph illustrates the impact of a 1.50% fee over 20 years on a $100,000 investment earning 5%.

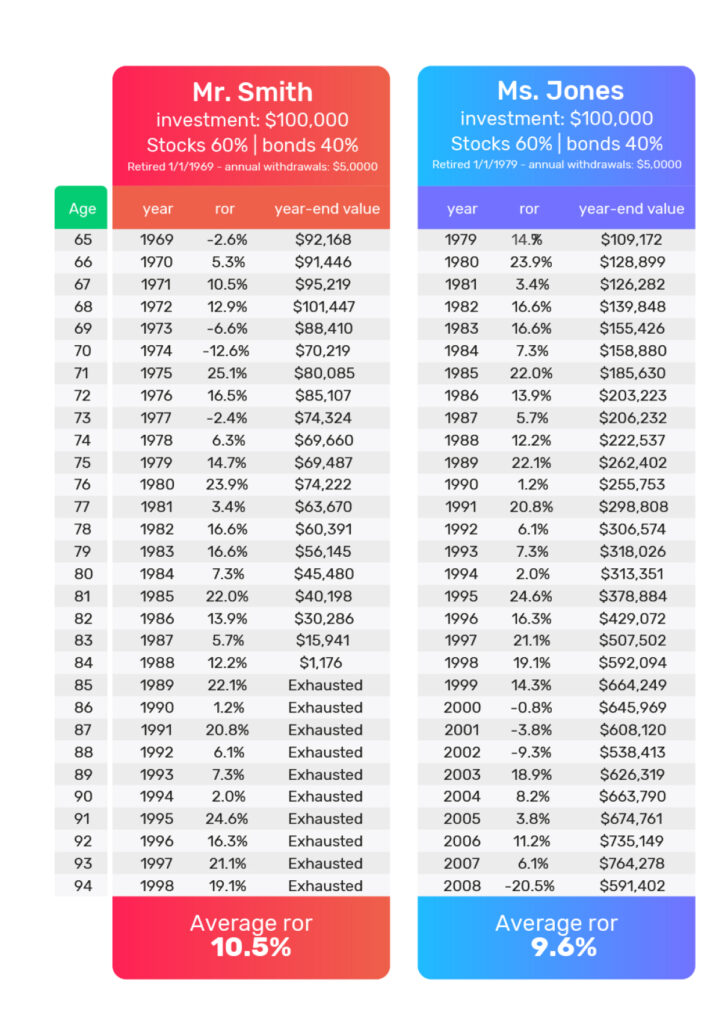

5. Eliminating Market Risk

A significant and concerning risk during retirement is known as Sequence of Returns Risk. This risk is determined by the order in which your investment returns occur. While an investment portfolio may boast an overall favorable average annual return, if a retiree encounters too many negative returns in quick succession while withdrawing funds for living expenses, they could potentially exhaust their retirement savings.

The graphic above shows actual market returns for different periods of time in U.S. history. Notice how the portfolio with the higher average annual returns results in depletion of the account by age 84 because of Sequence of Returns Risk.

6. Guaranteed Lifetime Income

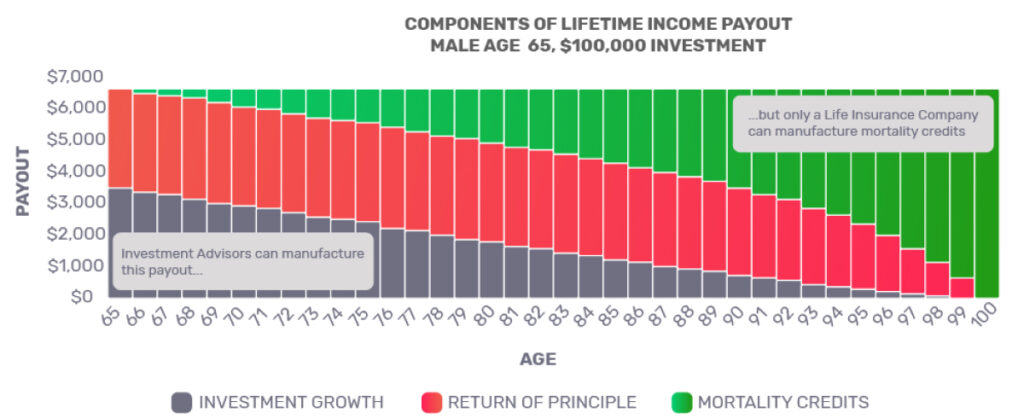

Annuities stand alone in their ability to provide guaranteed lifetime income. While traditional investments may offer retirees their principal and investment returns, annuities introduce a distinctive element known as Mortality Credits, exclusive to annuities like FIAs. These Mortality Credits can enable higher withdrawal rates during retirement compared to SAFEMAX rates and ensure a steady stream of income for life, irrespective of the depletion of funds.

7. Bypass Probate

Similar to life insurance, annuities bypass probate and go directly to beneficiaries.

LegalZoom.com reports that probate costs typically range from 2% to 4% of the estate, with certain states reaching as high as 7%.

If you had $300,000 in an annuity, you could potentially save up to $21,000 in probate expenses!